Trading Signals and Trade Ideas From FCA Regulated Experts

How do I calculate ‘R’?

We use ‘R’ to display our trading performance because we do not want to advise our clients on how much they should be risking per trade without any knowledge of their circumstances.

To also use it for your own trading performance is a personal choice and depends on your financial circumstances and tolerance for risk.

A couple of methods you could use to calculate ‘R’ are as follows.

Decide upon a fixed amount of capital to put at risk on each trade. This maybe £10 or £10,000, ultimately you need to be able to accept losing that amount and be comfortable.

Alternatively, you could use a fixed percentage (%) of your investment capital per trade.

E.g. You have an account of £10,000 and decide to risk 0.50% of that amount on a per trade basis. So 1R in this instance would be £50.

Your ‘R’ figure will change based on the value of the account in this scenario. So, if you lose 1R, your account will be £9,950. When you place the next trade and risk 0.5% your 1R figure will be £49.75.

Example of R in practise:

Buy FTSE at 7120, Stop at 7100, Target at 7180.

20 points is the difference between our stop and entry level.

If your strategy is to risk £100 per trade, then you divide the monetary value by stop amount.

E.g. £100 / 20 = 5

Trade size is £5 per point.

If the trade is stopped out. You will lose 20 points.

£5 per point x 20 = -£100 (or -1R)

If the trade hits the target. You will make 80 points.

£5 per point x 80 = £400 (or 4R)

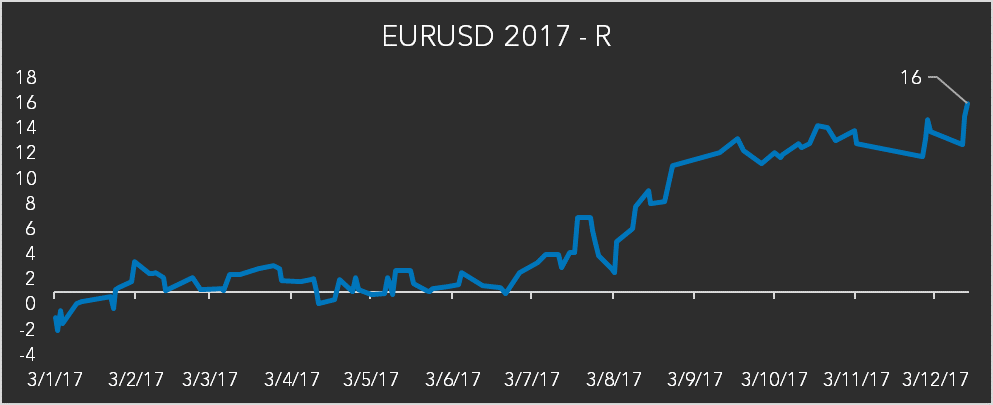

‘R’ in live environment

This is our 2017 EURUSD performance.

Trades: 98

Wins: 49

Losses: 42

Flat: 7

Average R: 0.163

The chart below displays the monthly ‘R’ return on EURUSD during 2017.

The chart below displays the ‘R’ return on EURUSD during 2017.

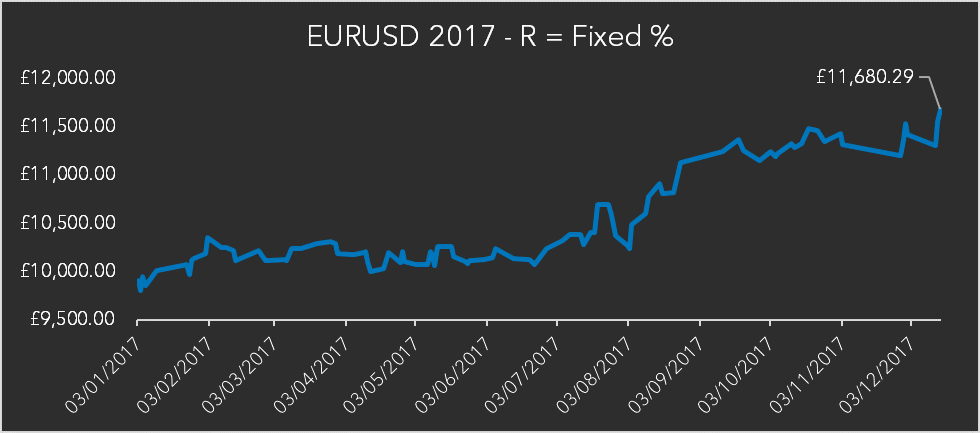

Example 1: Fixed % Risk

R = Fixed % Risk

Figures based on £10,000 trading account risking 1% of the capital per trade.

1R = £100

Returns over the period total £1,680.29 or 16.80%.

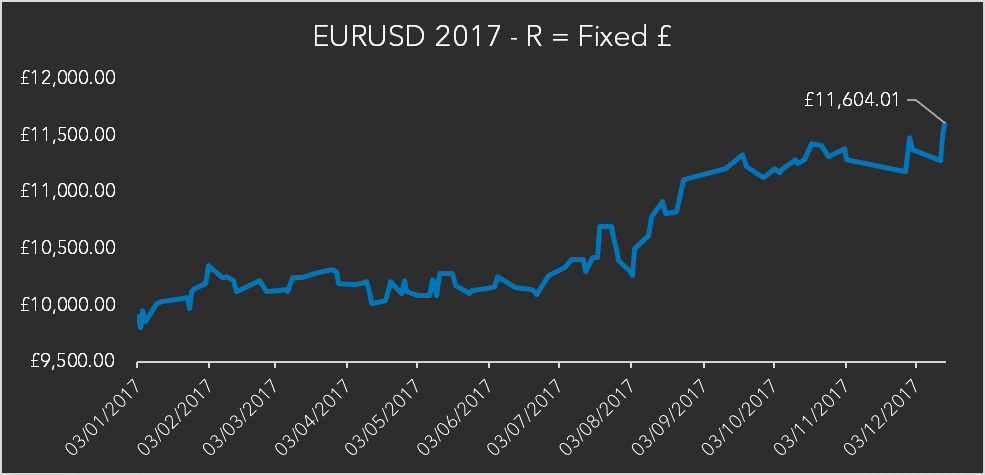

Example 2: Fixed £ Risk

R = Fixed £ risk

Figures based on £10,000 trading account risking £100 of the capital per trade.

1R = £100

Returns over this period total £1,604.01 or 16.04%.

*Returns are greater in example 1 because of compounding.

For more information please contact us.